CONTENTS

- Introduction: Why now?

- State of the US economy, the most powerful and resilient

- Geographical and sectoral differences: the US, a different and diverse world

- Impact on US international trade: open for business

- Status and forecast of travel restrictions: changes coming up soon

- Immigration restrictions: obstacle and opportunity

- Business opportunities: plentiful if you look carefully

- Conclusions

1. Introduction: Why now?

The famous US scientist Carl Sagan once said:

Extinction is the rule. Survival is the exception

This idea, related to the species that populate the Earth, can be extrapolated to the business world. Under normal conditions, in developed economies more than two thirds of companies disappear before reaching the age of 10. Half of SMEs do not reach 5 years. But this coronavirus can have for many businesses an impact similar to that of the meteorite that led to the extinction of the dinosaurs 66 million years ago.

Paraphrasing Charles Darwin, father of the theory of evolution by natural selection, the companies that will survive this crisis without precedent in the last century created by COVID-19 will not be the strongest or the most intelligent, but rather those that demonstrate a greater ability to adapt to the changes in the environment. In many cases it will not be enough to cut costs and wait for the storm to subside, but it will be imperative to redefine the business model.

Traditionally, an economic crisis reduces the levels of foreign direct investment. The natural tendency of executives is to cut expenses and focus on managing the short term. However, looking back, the companies that were able to navigate the Great Recession of 2008 more successfully were those that demonstrated the maximum agility and flexibility to quickly adapt their offer through innovation and internationalization.

Business internationalization may become a requirement for survival

In Spain, examples of success in internationalization during the previous crisis were Inditex (Zara), OHL or Mango, which undertook a strong development of the international markets with the greatest potential (ref El País). Several auto makers such as Honda, Toyota, Nissan or BMW significantly increased their investment in the US during that stage (ref PPI).

Reading what the media tell daily about the situation in the US, with a brutal drop in demand, unemployment levels not seen since the Great Depression of the 1930s, travel bans for many countries and suspension of immigration, it is easy to conclude that there could be no worse time than now to come to this market. However, the US economy currently provides exceptional opportunities that can be exploited by carefully analyzing objective facts, having enough flexibility to adapt to new circumstances, and following the right strategy to achieve success.

This article examines the current situation in the US paying special attention to the most relevant factors for foreign companies that intend to do business in this country. We will analyze the state of the US economy in general and its geographic and sectoral variations, we will review the impact on international trade with the United States, on travel to this country and on immigration. We will also highlight the business opportunities created by this crisis in the US for companies and professionals around the world.

2. State of the US economy, the most powerful and resilient

Some people say that…

Economy is the science of explaining tomorrow why the predictions you made yesterday didn’t come true today.

Without a good crystal ball, it is impossible to make a reasonable prediction in this context. In any case, within the undeniable severity of the situation, there are signs that allow us to harbor a moderate optimism about the possibility of a rapid recovery in economic activity.

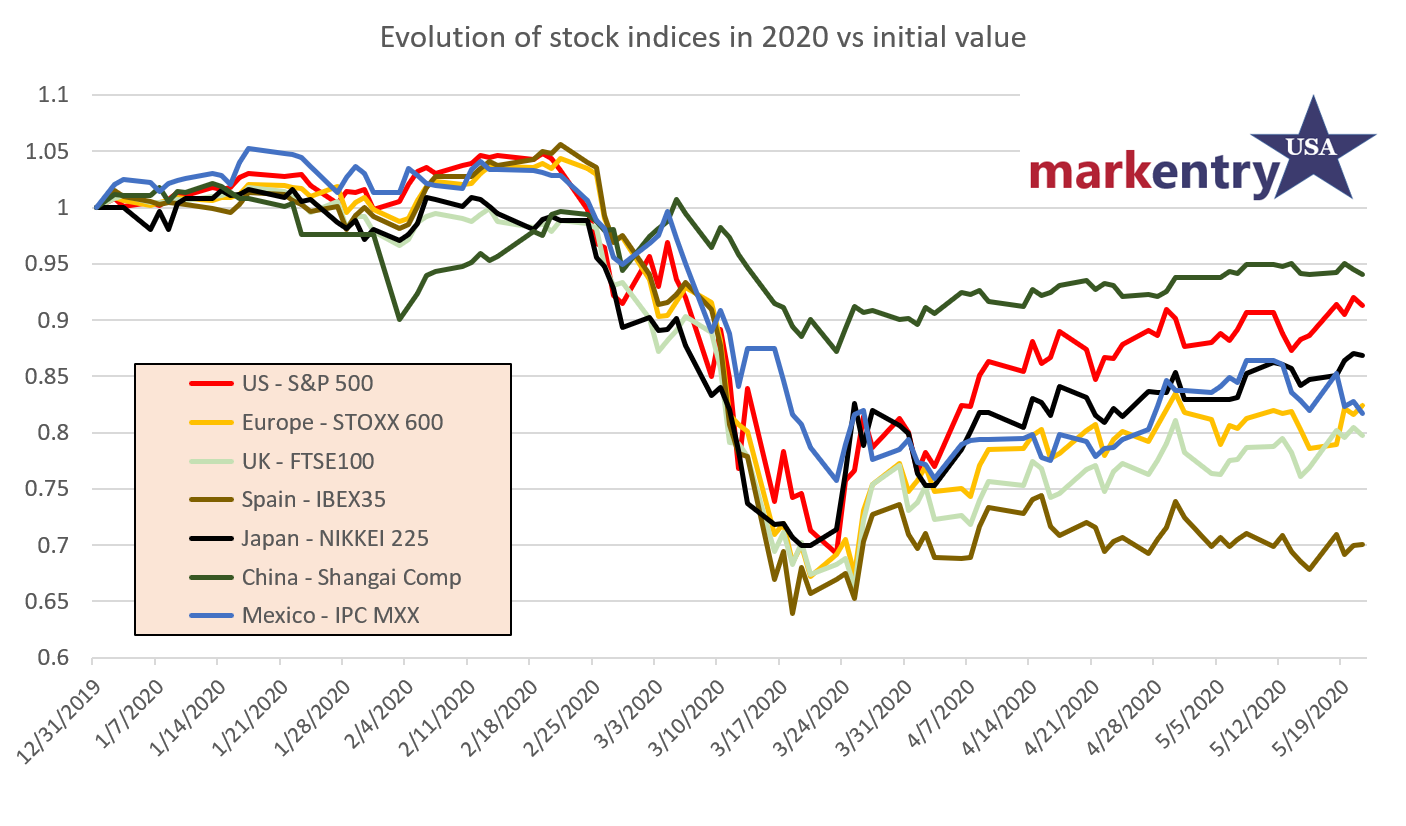

It is of great interest to study the evolution of the Stock Market, which, regardless of the erratic nature it may have in the short term, is still the best thermometer we have to measure the expectations of economic agents on business results in the future. Some relevant facts:

- Between the end of February and the middle of March of this year, the US stock market had the 5 biggest drops in points in its history, losing 34% of its value (S&P 500).

- However, as of May 22, the S&P 500 index had risen 31% from its lowest point of the year reached on March 23, recovering the level it had in mid-October 2019.

- On that date, the NASDAQ technology index showed gains of 4% since January 1 of this year, having recovered the losses experienced during the crisis.

- In the following chart we see the evolution of the US S&P 500 index compared with other international benchmark indices during 2020 compared to the initial value. With the exception of China (just 6% drop this year), the main indices have had greater falls than the US (9%), reaching 30% in the case of the Spanish IBEX-35.

All of this was happening in a context in which unemployment soared to levels never seen in the US since the Great Depression of the 1930s, jumping from 3.5% (the lowest level in 50 years) to 14.7% in April, with expectations that it will continue to rise, according to Goldman Sachs up to 25% (ref CNN). In the month of April alone, 20.5 million jobs were lost.

It is important to note that unemployment is especially pronounced in very specific activities, such as restaurants, hotels, shops and airlines. However, in the technology sector it has decreased this year, going from 3% to 2.8% (ref Forbes).

The contrast between the evolution of the stock market and unemployment in recent weeks is the subject of wide debate among experts. It seems that the markets are optimistic about a relatively fast recovery and that they take into account positive aspects such as the following:

- The state of the US economy before the start of the crisis was very strong, after the longest period of growth in recent history, a rise in the stock market of almost 30% in 2019 (S&P 500) and unemployment at the lowest level in the last 50 years.

- International investors continue to see the US as the most solid refuge from a crisis like the current one, which has cushioned the fall compared to other stock markets as we have seen before. As an example, it is estimated that the fall in production in the US by 2020 will be much lower than in the European Union, -2.5% vs. -5.2% in an optimistic scenario and -8.1% vs. -11.1% in a pessimistic scenario (ref McKinsey).

- The crisis is caused by the shock of a temporary non-economic factor that, if it can be overcome or at least mitigated within a reasonable period, should not affect the foundations of the economy.

- Despite the political confrontations, the response of the US Government has been swift and forceful, through a wide spectrum of fiscal, monetary and economic policy actions that seek to give the necessary support to companies and families to resist during the confinement for the time needed to slow down the spread of the pandemic and prevent the collapse of health systems. The volume of aid is gigantic and unprecedented, far exceeding what was disbursed in 2009 during the Great Recession and reaching 2 US trillion (2 European billion ) dollars by mid-May. New packages are expected to be approved in the near future.

- The degree of investment and innovation in the technologies necessary to overcome the current challenges is reaching stratospheric levels, due to the immense economic and human incentives that have been created.

Organizations around the world are investing billions of dollars in research and development of new drugs (more than 1,700 clinical trials), vaccines (more than 150 initiatives underway, 13 of them already in the testing phase) and diagnostic methods, collaborating and sharing information with each other in an extremely active way (ref McKinsey). Today, progress is promising, and scientists are cautiously optimistic about having a vaccine in record time (ref New York Times).

- The positive evolution of the metrics of the pandemic in most of the main economic powers in the world.

- Countries that have been completing recovery stages after their initial outbreaks such as China and South Korea and, soon, several European estates, are showing the way to achieve a progressive normalization of the economy.

- Interest rates are at the lowest levels in history, to the point that it has been said that they could be negative, essentially this means having to pay somebody to store your money (ref NBC News). All this facilitates access to credit and makes it easier for money to go back to the stock market and business investments, since there are no minimally attractive alternative financial investments.

- The prediction models, refined with the experience of countries in more advanced stages, have allowed us to create projections of how the situation will evolve that many agents consider relatively reliable, such as the one shown in April below (ref Morgan Stanley), which has been fulfilled by now. This makes it possible to create reopening plans.

Undoubtedly, the situation could change substantially in the coming months depending on various factors that would modify the evolution of the pandemic:

- The successful application of any of the multiple drugs that are being tested against the disease or success in the development of an effective and safe vaccine would contribute significantly to partially normalizing the economic activity more quickly.

- Conversely, the appearance of new outbreaks of the disease during the progressive reopening that is already beginning in most states would increase the depth of the economic crisis, jeopardizing the financial system as a whole due to the impossibility of extending indefinitely the aid that has allowed companies and workers to endure the situation so far.

3. Geographical and sectoral differences: the US, a different and diverse world

You have to be careful with averages and statistics:

Obviously, the impact of COVID-19 is very unevenly distributed in different regions and in each sector.

Some activities, such as air transportation, have suffered a huge damage that is already causing bankruptcies and will take years to fully recover. The sector has experienced a 70% drop in the stock market this year until mid-May. Even Warren Buffet, one of the top investors, has admitted it by leaving the sector entirely (ref Bloomberg).

Others, such as Internet sales, have benefited significantly from changes in consumption patterns. As an example, Amazon has hired 175,000 workers in just 2 months (ref GeekWire) and its value has grown 30% in the stock market this year.

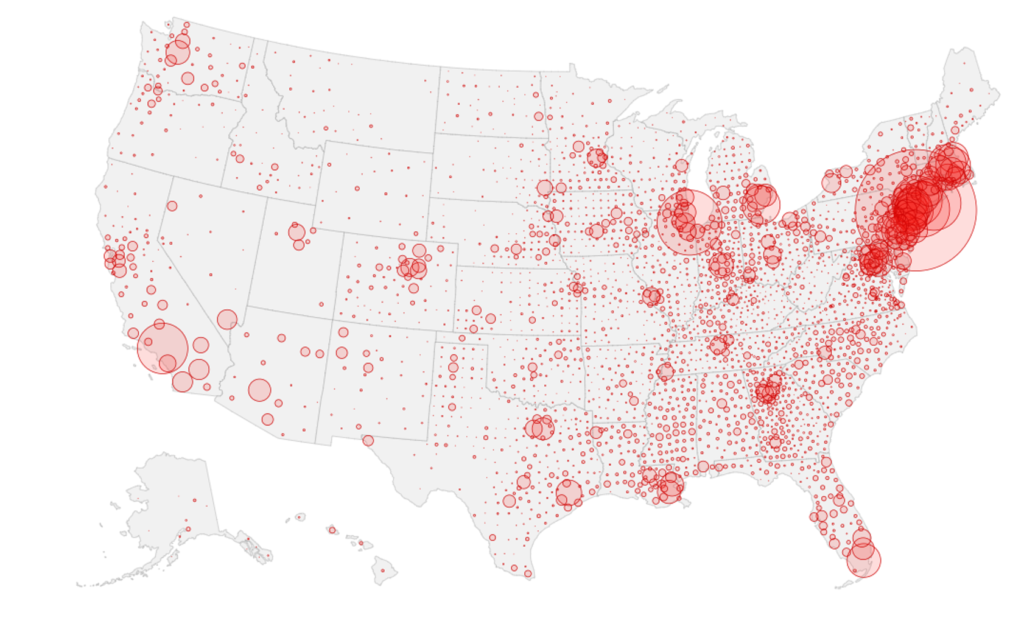

Similarly, the number of deaths per million caused by COVID-19 also gives us an idea of the enormous difference in the impact of the pandemic among states. New York State and surrounding areas are by far getting the worst part. As we see in the following figure, there is a high concentration in the Northeast of the country (especially in metropolitan areas of cities such as Boston, Washington DC and Philadelphia), very specific states such as Louisiana or Michigan and some urban areas. In 34 of the 50 states the value of this rate is less than a tenth of the value found in New York.

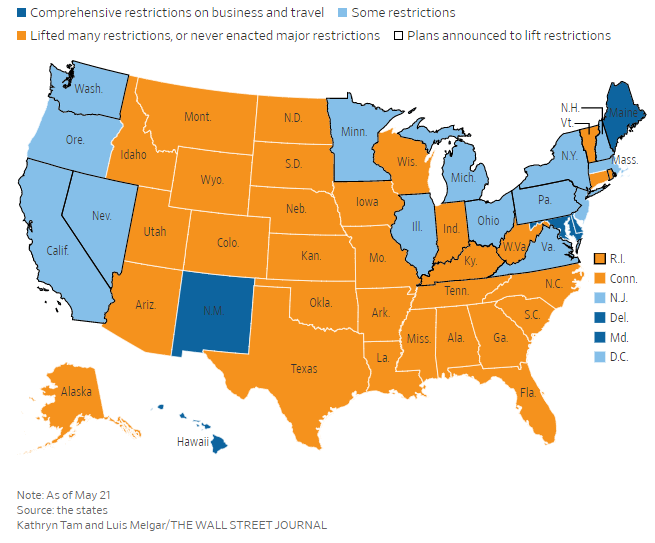

Another aspect that must be taken into account when understanding the local impact of the crisis in each region is the distribution of authority among the local, state and federal governments. Although the federal government, through the decisions made by the White House and the different agencies and ministries, directs the management of the crisis and the elaboration of guidelines, the decisions of confinement and reopening as well as the management of the necessary resources (elaboration of tests, temporary deployments of medical facilities to avoid overflow) correspond largely to the Governors of each state (who sometimes delegate certain decisions to each county). This has led, on one hand, to high friction between the federal government and some governors and, on the other, to a very unequal management of the reopening process, in which certain states have been reducing restrictions despite not having reached the criteria proposed by the corresponding federal agency for the different phases (ref CDC – Center for Disease Control).

Apart from the socioeconomic diversity that explains the uneven impact of the crisis on each state, one of the factors that affects both the response of the governors and the behavior of the population is the high degree of politicization of the crisis, which is perceived very differently by Democratic and Republican voters.

The percentage of Democrats who perceive the Coronavirus as a serious threat to the health of the population is double that of Republicans (ref PEW)

For all these reasons, the level of confinement varies enormously from one state to another and will evolve unevenly in the coming months. A good source to know the situation at each moment for each state is the guide provided by the Wall Street Journal for this purpose. The map shown below shows in orange the states that have lifted many restrictions or have not imposed any major ones, in light blue those that maintain some and in dark blue those that preserve a high number.

4. Impact on US international trade: open for business

For a long time, trade between the US and other countries has been hurt by a growing level of US protectionism with a sharp increase in some tariffs, aggressive renegotiation of trade agreements by the US, and belligerence in various large-scale conflicts. Among these is the resolution of the trade dispute with the European Union regarding public aid provided to Airbus, initiated by the US in 2004 and resolved in October 2019, when the World Trade Organization (WTO) gave the US government the green light to impose tariffs of 7.5 billion dollars on the goods of the European Union (EU). A similar and reverse demand regarding US aid to Boeing will be settled by the WTO in the coming months and could lead to similar tariffs on US products imported by the EU.

In the midst of this climate, the COVID-19 crisis considerably increases tensions over trade with the United States in multiple ways:

- It has affected the operations of the WTO by delaying ongoing procedures

- It has led to restrictions and controls on the exports of essential medical supplies during the crisis, such as respirators, personal protective equipment and test kits

- It has created problems in the supply chains due to the difficulties encountered by many manufacturers to maintain their production rates due to the confinement measures and the freeze on non-essential activities imposed in their regions.

Despite this, the US has made it clear at all times that travel bans on people imposed in early March do not affect freight.

Trump has stated in several occasions that “The free flow of commerce between the United States and the Schengen Area countries remains an economic priority for the United States” (ref White House), and has provided the same commitment for the UK, Ireland, Canada and Mexico.

Given the loss of tens of millions of jobs in just 2 months and the problems generated in the supply chains of many companies, it is expected that there will be a short-term increase in the domestic production of goods, both due to the political interest in reducing unemployment as well as the incentive of many companies to reduce some risks and take advantage of the abundance of available workers. However, the existing temporary situation does not modify the foundations of the unstoppable globalization process, which requires any country and any company to maintain a high degree of international competitiveness.

On the other hand, the wave of protectionism that has prevailed in US trade policy in recent years may end abruptly if the management of the crisis takes its toll on Trump and he does not succeed in the presidential elections of November this year, in which the balance of power in the House of Representatives (with a Democratic majority today) and the Senate (currently controlled by Republicans) will also be decided.

5. Status and forecast of travel restrictions: changes coming up soon

On the date this article is being written, according to the restrictions published by CDC, travelers who have been in the last 14 days in China, Iran, European countries in the Schengen area, the United Kingdom, Ireland and, since May 24, Brazil, cannot enter the United States, with very few exceptions, which includes US citizens or permanent residents (‘Green Card’ holders), in which case they must enter the country through one of the 13 airports designated for it and remain under quarantine for 2 weeks on arrival. In addition, the US has imposed a ban on non-essential travel to the country from Canada and Mexico that has recently been extended until June 22 (ref DHS).

Surprisingly, these travel restrictions that were activated in March have barely been updated to take into account the evolution of the disease in each region. This is difficult to understand since today China (in the list) has less than 100 active cases, while Russia (not included) has already exceeded 300,000 cases and is the third country with more cases in the world. In addition, European countries that have controlled the situation and have started to reopen continue to appear on the black list, despite having prevalence rates (measured as active cases per million residents) that are one tenth of New York ‘s.

The following graph (made with Worldometers data) shows a set of US states (names in black) and countries (in red those subject to travel bans, in green those that do not have any at the moment). As we see, the current restrictions do not make much sense. Given that the virus has already spread in most states, the risk caused in Florida by a visitor from New York, who can travel within the US without any restrictions, is 12 times greater than that created by one from Spain (which has similar levels of tests per resident). The differences in the number of tests per resident do not seem to indicate that prevalence rates of most of the countries shown could be considered as less reliable.

Although for now it seems that the restrictions will be maintained (ref CNN), it is to be expected that as the situation in the US and other countries is controlled, the restrictions will be reduced and rationalized, taking into account the prevalence rate in the area of residence of travelers and the control measures taken in each region.

Another very different issue will be the availability of flights. The main airlines already have plans for the slow but progressive resumption of international flights starting in late May and June, starting with the most important routes. All seek in record time to establish protocols that transmit a feeling of security to their passengers, as is the case of United Airlines, creating recently an alliance with Clorox, a manufacturer of disinfectants, and Cleveland Clinic, an academic medical center (ref BizNews).

6. Immigration restrictions: obstacle and opportunity

Since March 20 visa procedures have been suspended in all US embassies and consulates worldwide, with very few exceptions such as medical personnel and essential temporary workers. However, the ‘visa waiver program’ is maintained, allowing citizens from 39 countries (including most from the European Union) to enter the US for tourism or business and stay up to 90 days as long as travel restrictions cited in the previous section do not forbid it . On April 22, Trump suspended the entry of new immigrants with permanent residence (‘Green Card’) for 60 days.

All this has produced countless internal problems, impacting sectors that depend on immigrant workers and jeopardizing the solvency of DHS (Department of Homeland Security) due to the disappearance of income from processing fees. Above health considerations, the main motivation for these measures is undoubtedly to reduce unemployment, which is at stratospheric levels due to the crisis.

The situation is a nightmare for immigrants on temporary visas. It is estimated that more than 250,000 workers who were waiting for their ‘Green Card’ may be forced to return to their country of origin in June (ref L.A. Times). The paradox is that many of them are qualified personnel with H1 visas in very low unemployment sectors (2.8% in April in the technology sector) that have hardly been affected by the crisis or have even benefited. It is unlikely that restaurant employees will replace foreign programmers who cannot extend their stay.

7. Business opportunities: plentiful if you look carefully

This quote from General Sun Tzu, in the book “The Art of War” from the 6th century BC reminds us that the unprecedented situation caused by COVID-19 undoubtedly presents business opportunities especially for those who can anticipate the evolution of events and find their niche in the new reality. Some ideas:

- Obviously, the demand for products and services that can directly help prevent, control or mitigate the effects of COVID-19 is massive. This is creating countless opportunities of all kinds. For example, the Spanish company GoAigua has created a subsidiary in the US that offers a system for measuring virus levels in populations through analysis of wastewater, which can be of great value as an early warning of new outbreaks during reopening phases (ref Yahoo Finance).

- In the same way, in all organizations the demand for tools and services that support remote work has exploded: videoconferences (Zoom has multiplied by 2.5 its value on the stock market in 2020 until mid-May), team collaboration, cloud computing, etc.

- The crisis has created a demand for innovations that will allow to restart travel and activities in restaurants and hotels safely, as restrictions are reduced. This includes a wide variety of ideas such as thermal cameras to detect people with a fever, image processing systems to identify violations of mandatory mask use, or the deployment of robots instead of humans for some services.

- The confinement that still exists in many urban areas and bans on international travel will likely be eased gradually in the coming weeks. However, immigration restrictions are likely to remain in place for many months (due to political motivation in the face of unemployment) and teleworking will continue to be encouraged until an effective vaccine is available for most of the population. Some organizations like Twitter have decided that remote work will become a permanent option for their employees. This favors the global search for talent and is an opportunity for companies and ‘freelance’ workers that can provide qualified remote professional services, especially when their cost differential with respect to the United States is highly competitive, given the enormous pressure on customer budgets.

- The rise of the ‘contactless economy‘ is probably a trend that will produce permanent changes in purchases (apotheosis of e-commerce, modification of payment processes in stores and restaurants) and in a wide variety of services.

Among the new users of online sales channels, 86% are satisfied and 75% plan to continue using them after the end of the crisis (ref McKinsey).

- The demand for some services that can be delivered remotely will far exceed existing capacity for some time. As an example, the use of telemedicine has increased 50% in the US in recent months (ref McKinsey). Psychologists providing distance therapy have seen growth of up to 65% in recent months (ref Washington Post).

- The financial crisis has pushed to the limit a high number of US corporations that are dangerously approaching their death. The number of companies that have filed for ‘Chapter 11’, a legal protection mechanism that allows a business to reorganize and try to avoid bankruptcy, has grown in April by 26% compared to the previous year (ref CNBC) and it is expected that this percentage will continue going up as the crisis develops. Big store chains like J. Crew and Neiman Marcus, car rental companies like Hertz, and others from sectors apparently not impacted as directly, like telecommunications (OneWeb, Intelsat) have already arrived at this dangerous situation. This is generating acquisition opportunities as a market entry strategy, a process that must be carried out with the utmost precautions, but which can significantly accelerate the development of a local presence in the United States.

8. Conclusions

Rahm Emanuel, Chief of Staff with President Obama and Mayor of Chicago between 2011 and 2019, is known among many other things for the following quote:

Never let a good crisis go to waste

We have no control over how events will evolve, we must focus on minimizing long-term risks and taking advantage of the opportunities offered by this historical situation.

Without a doubt, the organizations that successfully navigate this crisis will be strengthened and will have developed agility, flexibility and resilience that will allow them to face a future full of uncertainty with much greater confidence. The COVID-19 will pass, but the environment will continue to be even more ‘VUCA’ (Volatility, Uncertainty, Complexity and Ambiguity). Exponential technological disruption, global warming and, potentially, other pandemics will present new challenges, but also opportunities for those who know how to take advantage of them. Our society’s values and consumer expectations will evolve rapidly in parallel with these changes.

In this context, it can be essential for any company to achieve a solid presence in a variety of markets to facilitate access to resources globally and have a greater capacity to absorb the ups and downs of local demands. The internationalization of a business may cease to be an option and become a survival requirement.

After this crisis, the United States will continue to be the largest, most dynamic and most resilient economy in the world. The opportunities presented by the current crisis for entry will not be available for long.

Share this:

- Click to share on LinkedIn (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to share on Telegram (Opens in new window)

- Click to print (Opens in new window)

- Click to share on WhatsApp (Opens in new window)